Core Recommendation and State Response

- The 16th Finance Commission (FC-16) retained 41% vertical devolution for States from the divisible pool.

- Eighteen States demanded an increase to 50%, while others sought 45–48%.

- The Centre advocated moderation, favouring fiscal flexibility over higher State transfers.

Structural Issue: Shrinking Divisible Pool

- The divisible pool excludes cesses, surcharges, and collection costs, reducing shareable revenue.

- The Centre increasingly relies on non-shareable levies, limiting State fiscal space.

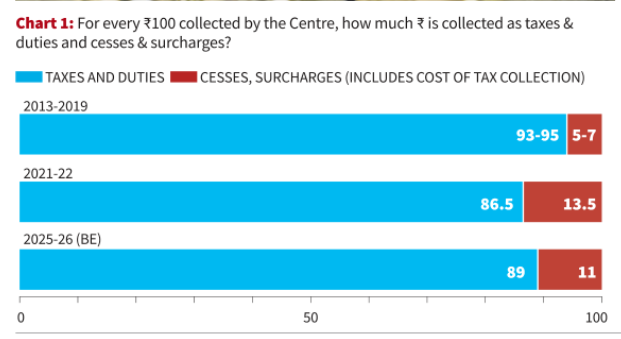

- Between 2013–2019, ₹93–95 per ₹100 formed the divisible pool.

- In 2021–22, only ₹86.5 per ₹100 was shareable, with ₹13.5 as cesses and surcharges.

- For 2025–26, estimates show ₹89 shareable and ₹11 non-shareable per ₹100.

Evidence from GDP and Absolute Collections

- Non-shareable revenues rose from 1.1% of GDP in 2011–12 to 2.2% in 2023–24.

- Divisible pool hovered around 9.1–9.4% of GDP, showing limited expansion.

- Cesses collections increased from ₹44,688 crore in FY15 to ₹3,52,650 crore in FY22.

- Surcharges rose from ₹15,702 crore in FY15 to ₹40,758 crore in FY22.

FC-16 Justifications

- The Constitution does not cap cesses and surcharges, allowing Centre fiscal discretion.

- These levies fund emergencies, including war, famine, and pandemics.

- The Commission highlighted defence needs and infrastructure efficiency as Centre priorities.

- It asserted States have sufficient resources to meet constitutional responsibilities.

Critiques and Unresolved Questions

- The rising share of non-divisible revenues weakens State fiscal autonomy.

- High-performing States receive limited gains despite productivity contributions.

- FC-16 suggested a voluntary Centre shift toward regular taxes to expand the pool.

- Critics question whether constitutional intent supports such cess-driven centralisation.

Implications for Fiscal Federalism

- Transfers to States grow, but 42% of increases come through Centrally Sponsored Schemes.

- This reinforces a model where States implement Centre-defined priorities.

- The article concludes structural reform is required to restore federal balance.