Syllabus: Issues and challenges pertaining to the federal structure

Background: Centre–State Transfers

- Central tax revenues are shared with States based on Finance Commission (FC) recommendations.

- Transfers occur through tax devolution, grants-in-aid, and Centrally Sponsored Schemes (CSS).

- The 15th Finance Commission recommendations are in force; 16th FC report is pending.

- Debates focus on fiscal autonomy erosion after GST implementation.

- Concerns include GST revenue losses, rising cesses and surcharges, and CSS spending rigidity.

- High-performing States allege declining devolution shares despite strong revenue contributions.

- FCs historically prioritised equity over efficiency, using income distance and population criteria.

Tax Collection versus Economic Contribution

- States like Maharashtra, Karnataka, Tamil Nadu argue they contribute more than they receive.

- Direct tax data reflect place of collection, not place of income generation.

- Multi-State firms pay taxes where registered offices are located, distorting State attribution.

- Labour migration and multi-location operations further weaken PAN-based tax attribution.

- Hence, direct tax figures are unreliable for estimating State-wise tax contribution.

GSDP as a Proxy for Tax Accrual

- Gross State Domestic Product (GSDP) represents the underlying tax base of a State.

- Assuming uniform tax efficiency, GSDP share approximates tax accrual capacity.

- GST, being destination-based, poses fewer attribution concerns.

- Empirical evidence supports GSDP relevance.

- In 2023–24, correlation between GSDP and direct taxes was 0.75.

- Correlation between GSDP and GST collections was higher at 0.91.

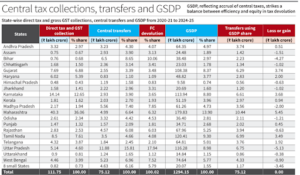

Transfer Outcomes under Current System

- From 2020–21 to 2024–25, States received 41% of gross tax revenues.

- Total transfers amounted to ₹75.12 lakh crore.

- Uttar Pradesh, Bihar, West Bengal received high transfers despite low tax shares.

- Maharashtra, Karnataka, Tamil Nadu contributed heavily but received modest transfers.

- Devolution shares correlated 0.99 with actual transfers, but only 0.24 with tax collections.

- GSDP share showed 0.81 correlation with tax collections and 0.58 with devolution.

Implications of a GSDP-Based Formula

- Pure GSDP-based transfers would benefit Maharashtra, Gujarat, Karnataka, Tamil Nadu.

- Uttar Pradesh, Bihar, Madhya Pradesh would face moderate reductions.

- GSDP balances efficiency and equity, improving fairness and system credibility.

- Higher GSDP weight acknowledges State contributions to national income.