Syllabus: Effect of policies and politics of developed and developing countries on India’s interests

Macroeconomic Context

- Rupee declined around 6% since April 2025, despite strong domestic economic indicators.

- Growth rate estimated at 7.4% for the current financial year.

- CPI inflation ended 2025 at 1.33%, below RBI’s lower target band consecutively.

- Current account deficit stood at 0.76% of GDP in first half of 2025–26.

Primary Cause: Capital Outflows

- Trade deficit rose to $96.58 billion in April–December 2025, from $88.43 billion last year.

- Net capital inflows of $10,615 million in 2024 turned into $3,900 million outflows in 2025.

- Capital exit triggered by U.S. 50% tariff on Indian exports and geopolitical tensions.

- Additional U.S. tariff threats linked to India’s oil imports from Russia and trade with Iran.

Shift from Economics to Diplomacy

- Capital flows driven by political risk perceptions, not conventional economic fundamentals.

- Earlier rupee depreciation in 2022 linked to U.S. Federal Reserve interest rate hikes.

- Present depreciation reflects weaponisation of trade tariffs for geopolitical leverage.

- Diplomatic engagement with the U.S. identified as key stabilising factor for rupee.

RBI’s Exchange Rate Intervention Approach

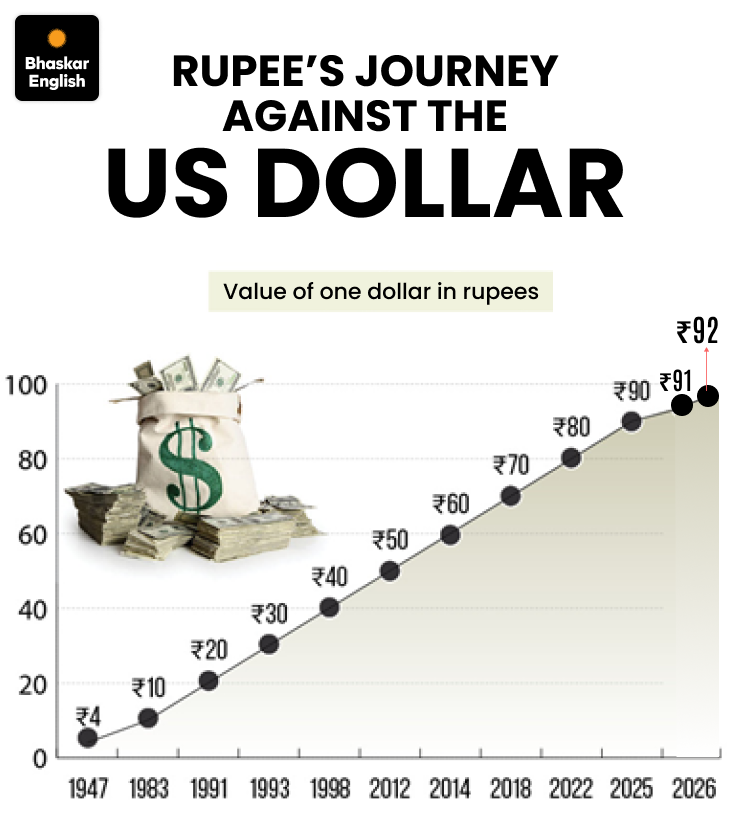

- Since 1993, India follows a market-determined exchange rate regime.

- RBI intervenes to reduce volatility, not to peg the rupee’s value.

- Intervention aims to moderate sharp declines and ensure smooth market adjustment.

- Non-economic pressures now influencing rupee beyond traditional macroeconomic variables.

Limits of Devaluation as a Policy Tool

- Rising import content of exports weakens competitiveness gains from rupee depreciation.

- High U.S. tariffs restrict potential export expansion in American markets.

- Essential imports, especially crude oil forming 25% of merchandise imports, become costlier.

- Depreciation risks fueling domestic inflation, undermining price stability.

Strategic Implications and Outlook

- India’s inflation aligned with developed economies, reducing justification for devaluation strategy.

- Real Effective Exchange Rate used to assess relative currency competitiveness.

- Continued capital outflows may pressure stock markets and investment sentiment.

- Early trade and diplomatic resolution with the U.S. critical for currency stabilisation.