Syllabus: Issues and challenges pertaining to the federal structure

Changing Role of Central Tax Devolution

- States closely track Union Budget to assess their share in Central tax devolution.

- Tax devolution no longer provides stable fiscal support for State finances.

- Rising dependence on State Development Loans (SDLs) reflects weakening revenue certainty.

Expansion of State Borrowing

- In 2024-25 Revised Estimates, SDLs formed 35% of Tamil Nadu’s revenues.

- Maharashtra’s SDL share reached nearly 26% of total revenue receipts.

- Borrowing surge accelerated after COVID-19 shock in 2020-21.

- Dependence on debt has persisted, replacing devolution as primary fiscal stabiliser.

- State PSUs and Special Purpose Vehicles increasingly borrow for routine expenditure.

Erosion of Effective Devolution

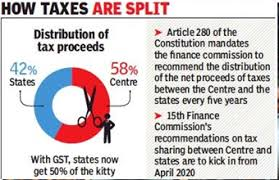

- 15th Finance Commission fixed States’ share at 41% of divisible pool.

- Growing cesses and surcharges lie outside divisible pool, reducing actual transfers.

- Industrialised States face greater impact due to large indirect tax bases.

- GST introduction in 2017 shifted major revenue collection to the Centre.

- Redistribution formula weakens link between tax effort and fiscal reward.

Welfare Financing and Growth Constraints

- Welfare commitments include pensions and mass health insurance for the poor.

- These obligations increasingly financed through domestic borrowing, not tax revenues.

- Debt reliance restricts public capital expenditure and private investment capacity.

Inter-State Borrowing Patterns and Risks

- West Bengal depends on devolution for 47.7% of average revenue receipts.

- SDLs still formed around 35% of its revenues over five years.

- Trend signals erosion of State fiscal autonomy and rising debt-to-GSDP ratios.

- Weak assured revenues create macroeconomic risks for federal fiscal sustainability.

Reform Imperatives

- Emphasise higher effective devolution instead of expanding State indebtedness.

- Rework horizontal devolution criteria to reward tax effort and efficiency.

- Bring cesses and surcharges into the divisible pool for equitable revenue sharing.