Budget Context and Strategic Vision

- Union Budget 2026 targets productivity enhancement and employment generation amid volatile global economic conditions.

- Finance Minister emphasised deep integration with global markets to attract stable, long-term investment.

- The Budget marked the ninth consecutive presentation by the same Finance Minister.

- No major direct tax rate relaxations were announced for individuals or corporations.

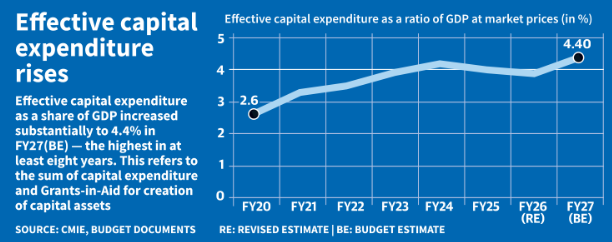

- The Centre’s capital expenditure target is set at ₹12.2 lakh crore for 2026–27.

- This exceeds ₹10.9 lakh crore Revised Estimates of 2025–26 and ₹11.2 lakh crore Budget Estimates.

- Capex is positioned as a growth multiplier for productivity, infrastructure, and employment creation.

Structural Reforms and Growth Framework

- The Budget aims to support Viksit Bharat 2047 through sustained growth and competitiveness.

- It focuses on building resilience to volatile global dynamics and boosting domestic capacity.

- Emphasis is placed on enhancing productivity across sectors through systemic reforms.

Three Kartavyas for Development

- First Kartavya

- Accelerate growth by strengthening manufacturing, infrastructure, and energy security.

- Targeted areas include seven strategic sectors, MSMEs, and city-economic regions.

- Second Kartavya

- Build capacity through education, skilling, and services sector development.

- Focus sectors include healthcare, medical tourism, AVGC, design, and animal husbandry.

- Third Kartavya

- Promote inclusion by empowering farmers, Divyang, and vulnerable populations.

Infrastructure and Regional Initiatives

- Support for rare earth corridors in Odisha, Kerala, Andhra Pradesh, and Tamil Nadu.

- Announcement of a new national waterway in Odisha connecting industrial and port regions.

- Launch of East Coast Industrial Corridor and a Dankuni–Surat freight corridor.

Trade and Energy Measures

- Customs duty reductions target marine, leather, and textile exports.

- Measures aim to accelerate India’s energy transition and export competitiveness.

Basics of Capital Expenditure in Government Budgeting

- Capital Expenditure (Capex) refers to government spending on creating long-term productive assets.

- It includes investments in machinery, buildings, health facilities, education infrastructure, and equipment.

- Capex focuses on capacity creation and future economic returns, not immediate consumption.

- Components of Capital Expenditure

- Acquisition of fixed and intangible assets such as infrastructure, technology, and institutional facilities.

- Upgradation of existing assets to improve efficiency, capacity, and service delivery.

- Repair and maintenance of assets to extend operational life and productivity.

- Repayment of government loans, which reduces public liabilities and fiscal burden.

- Multiplier Effect and Economic Impact

- Capex generates the highest multiplier effect among government expenditure categories.

- It stimulates ancillary industries, services expansion, and large-scale job creation.

- According to the National Institute of Public Finance and Policy, revenue spending yields ₹0.98 multiplier.

- Capex delivers a ₹2.25 multiplier in the same year and ₹4.80 over full expenditure cycle.

- Role in Productivity and Stability

- Capex improves labour productivity by strengthening physical and institutional infrastructure.

- It functions as a macroeconomic stabiliser during economic downturns.

- It supports countercyclical fiscal policy by boosting demand and investment during slowdowns.

- Revenue Generation and Fiscal Benefits

- Asset creation enables long-term revenue streams through improved operational efficiency.

- Repayment of loans under capex helps in reducing government liabilities.

- Government capex crowds in private investment, expanding production capacity.

- Contribution to Economic Growth

- Sustained capex accelerates economic growth and employment generation.

- It strengthens the foundation for long-term development and industrial expansion.