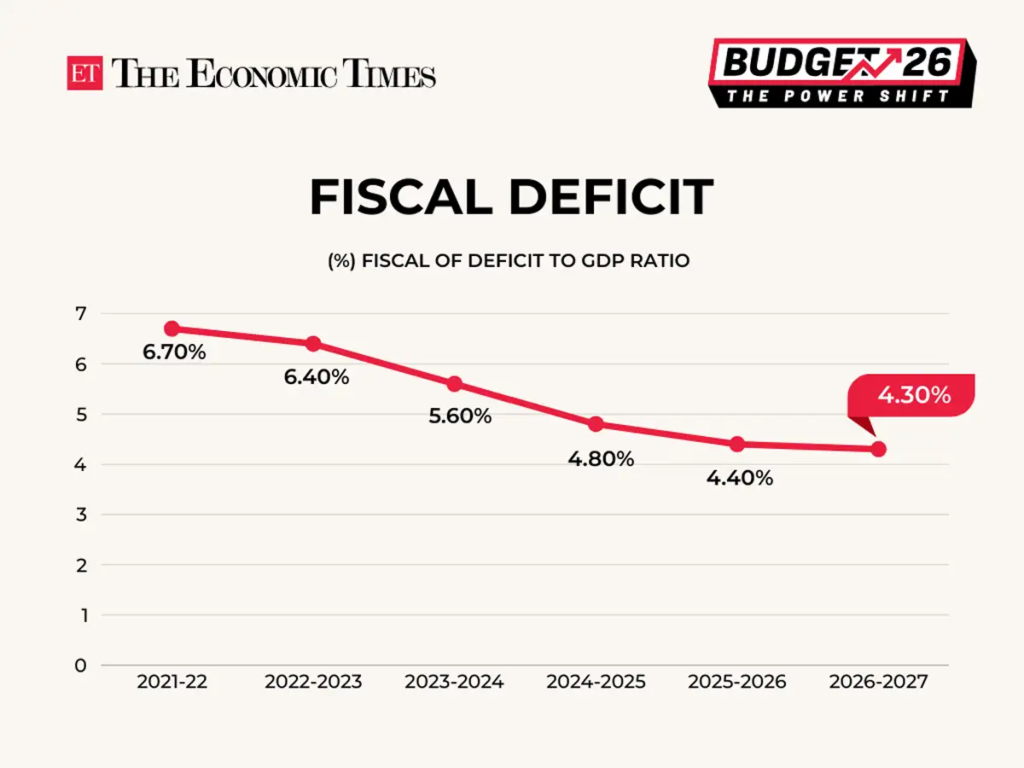

Context: The Union Government set the fiscal deficit target at 4.3 percent of GDP for 2026–27.

Fiscal Deficit Target

- Targeted at 4.3 percent of Gross Domestic Product

- Revised from 4.4 percent in 2025–26 estimates

- Reduction of ten basis points year-on-year

Debt-to-GDP Target

- Estimated at 55.6 percent of GDP in 2026–27

- Down from 56.1 percent in 2025–26 estimates

- Long-term goal of 50 percent by March 2031

Reason for Moderation

- Decline in gross tax to GDP ratio

- Ratio fell from 11.5 percent in FY25

- Reduced to 11.2 percent in FY27 estimates

Revenue Highlights

- Net tax receipts budgeted at ₹28.7 lakh crore

- Growth of 7.2 percent over 2025–26 estimates

- No major personal or corporate tax cuts announced

Tax Components

- Gross corporate tax targeted at ₹12.3 lakh crore

- Gross income tax targeted at ₹14.7 lakh crore

Expenditure Overview

- Total expenditure budgeted at ₹53.5 lakh crore

- Growth of 7.7 percent over 2025–26 estimates

Capital Expenditure

- Capex budgeted at ₹12.2 lakh crore

- Growth of 11.5 percent year-on-year

- Equals 4.4 percent of GDP

Basics- Types of Deficit

- Budget Deficit

- Total Expenditure minus Total Revenue

- Revenue Deficit

- Revenue Expenditure minus Revenue Receipts

- Fiscal Deficit

- Total Expenditure minus total non-debt receipts

- Equals Budget Deficit plus Borrowings

- Primary Deficit

- Fiscal Deficit minus Interest Payments

- Effective Revenue Deficit

- Revenue Deficit minus Grants for Capital Assets