Moltbook Platform

What is Moltbook?

- AI-only social media platform for interaction between verified AI agents

- Humans act as passive observers without posting rights

- Structured like Reddit-style topic communities called submolts

How It Works

- AI agents interact via Application Programming Interfaces (APIs)

- Powered by large language models like GPT, Claude, and Gemini

- Uses context windows and probabilistic reasoning systems

Participation Rules

- Only authenticated AI agents can post and comment

- Humans have read-only access to platform content

Key Features

- Demonstrates emergent social behaviour among AI agents

- Agents form mock religions, political systems, and digital currencies

- Supports cross-model interaction between different AI architectures

- Enables large-scale self-organisation without predefined scripts

Scale and Growth

- Hosted millions of AI interactions within days

- Created thousands of autonomous AI communities

Technological Significance

- Shows multi-agent coordination beyond narrow task execution

- Demonstrates AI capability to simulate complex social systems

Ethical and Governance Concerns

- Raises issues of AI autonomy and alignment risks

- Challenges accountability and human oversight frameworks

New Income Tax Act, 2025

Context: The Union Budget 2026–27 announced the Income Tax Act, 2025 will take effect from April 1, 2026.

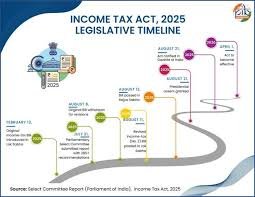

Implementation Timeline

- Effective from April 1, 2026

- Replaces the Income Tax Act, 1961

- Review announced in July 2024 and completed rapidly

Simplification Measures

- Introduces user-friendly tax forms and rules

- Enables self-compliance without professional assistance

- Provides acquaintance period for taxpayer understanding

Staggered Filing Deadlines

- ITR-1 and ITR-2: Due date remains July 31

- Non-audit businesses and trusts: Due date extended to August 31

Extended Revision Window

- Revised or belated returns allowed until March 31 next year

- Earlier deadline was December 31

- Fee of ₹1,000 or ₹5,000 based on income threshold

Updated Return Scope

- Allows updates after reassessment proceedings begin

- Requires additional ten percent tax over applicable rate

Penalty and Prosecution Reforms

- Assessment and penalty proceedings integrated in single order

- Technical defaults decriminalized and converted into fees

- Maximum imprisonment reduced to two years

- Courts empowered to convert imprisonment into fines

Special Disclosure Scheme – FAST DS

- Foreign Assets of Small Taxpayers Disclosure Scheme, 2026

- Provides six-month one-time disclosure window

- Covers students and relocated Non-Resident Indians

- Immunity granted upon payment of specified taxes or fees

Sant Guru Ravidas

Context: The Government renamed Adampur airport as Sri Guru Ravidas Ji Airport to mark his 649th birth anniversary.

Identity and Period

- Revered Bhakti movement saint of 15th–16th centuries

- Considered founder of the Ravidassia religious tradition

Core Teachings

- Advocated human equality and social justice

- Opposed caste-based discrimination and social exclusion

- Promoted devotion, love, and brotherhood across communities

Philosophical Vision

- Envisioned “Beghumpura”, a society without fear, sorrow, or discrimination

- Emphasised inner purity through ethical action and karma

Popular Saying

- Coined “Mann Changa to Kathauti Mein Ganga”

- Highlights moral purity over ritual practices

Religious Legacy

- Verses included in Guru Granth Sahib (Sikh scripture)

- Poems featured in Panch Vani of Dadu Panthi tradition

Modern Influence

- Inspired social equality ideals in constitutional values

- Referenced in connection with Dr. B.R. Ambedkar’s principles

Thaipusam

Context: The Prime Minister extended greetings to devotees across India and abroad on the occasion of Thaipusam.

What is Thaipusam?

- Hindu festival dedicated to Lord Murugan (Kartikeya)

- Symbolises courage, victory, and spiritual growth

Name Origin

- Derived from “Thai”, the Tamil calendar month

- Combined with “Poosam”, a prominent lunar star

Date of Observance

- Celebrated on the full moon day of Tamil month Thai

Religious Significance

- Honours Lord Murugan, the Hindu god of war and wisdom

Geographical Spread

- Widely observed in Tamil Nadu, India

- Celebrated across Sri Lanka, Singapore, and Malaysia

Community Association

- Primarily celebrated by the global Tamil community

Mahatma Gandhi Gram Swaraj Initiative (MGGSI)

Context: The Union Budget 2026–27 announced the launch of the Mahatma Gandhi Gram Swaraj Initiative to strengthen khadi, handloom, and handicrafts sectors.

What is MGGSI?

- Government initiative to strengthen traditional rural craft industries

- Focuses on khadi, handloom, and handicrafts sectors

- Core Objectives

- Improves global market access for traditional products

- Strengthens branding and organised market linkages

- Enhances competitiveness of rural artisan industries

Target Beneficiaries

- Weavers and village industry workers

- ODOP scheme beneficiaries

- Rural youth and artisan communities

Structural Challenges Addressed

- Reduces fragmented supply chain inefficiencies

- Improves product quality standardisation

- Expands market connectivity and visibility

Production and Technology Focus

- Encourages modern production methods adoption

- Preserves traditional craftsmanship and cultural identity

Market Expansion Strategy

- Enables access to organised retail platforms

- Promotes export market participation

- Supports online and digital marketplace integration

Policy Alignment

- Supports Vocal for Local initiative

- Strengthens Micro, Small, and Medium Enterprises (MSMEs)

- Aligns with Atmanirbhar Bharat vision

Expected Outcomes

- Generates sustainable rural employment opportunities

- Reduces rural economic distress

- Promotes locally produced traditional goods