Syllabus: Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment.

Context and Structural Shift

- India’s direct tax system has expanded significantly over the last decade.

- Growth reflects deeper formalisation rather than temporary compliance spikes.

- Expansion accompanied by improved tax administration efficiency.

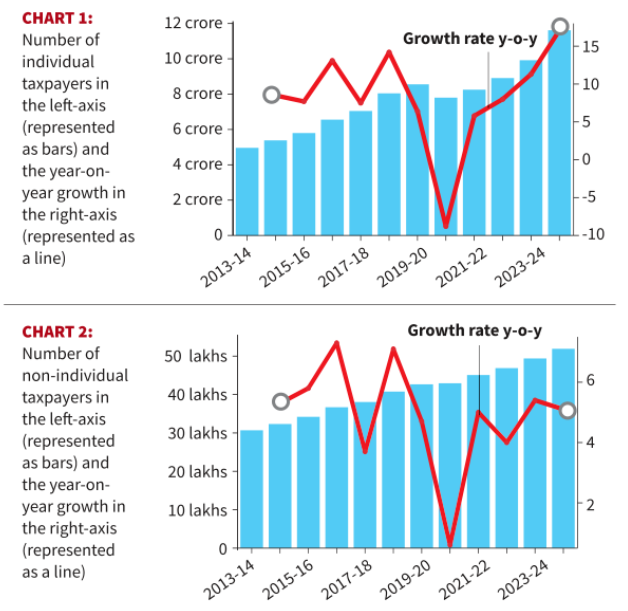

Overall Growth in Taxpayer Base

- Total taxpayers rose from 5.26 crore (AY 2013-14) to 12.13 crore (AY 2024-25).

- Taxpayer definition includes return filers and persons under TDS coverage.

- Base more than doubled over eleven years.

- Recorded CAGR of about 7.89%, indicating sustained expansion.

- Considered a major structural shift since PAN system expansion.

Growth in Individual Taxpayers

- Individuals remain the largest contributors to tax base expansion.

- Numbers rose from 4.96 crore to 11.61 crore.

- Growth recorded around 8% CAGR during the period.

- Pre-pandemic years saw steady high single-digit increases.

- AY 2020-21 witnessed nearly 9% decline due to COVID disruption.

- Post-pandemic years showed double-digit recovery and renewed momentum.

Non-Individual Taxpayer Trends

- Includes firms, companies, HUFs, AOPs, BOIs, and local authorities.

- Base rose from 0.29 crore to 0.48 crore.

- Growth recorded around 5% CAGR.

- Pre-pandemic expansion ranged between 4–7% annually.

- Pandemic year growth fell below 1%.

- Recovery remained gradual, stabilising near 5% growth.

Improvement in Tax Administration Efficiency

- Cost of direct tax collection declined sharply.

- Fell from 1.36% (FY 2000-01) to 0.41% (FY 2024-25).

- Pandemic caused temporary cost increase.

- Ratio later reached the lowest recorded level.

Drivers of Administrative Gains

- Adoption of digital filing systems streamlined compliance.

- Introduction of pre-filled returns reduced taxpayer burden.

- Faceless assessments improved transparency and speed.

- Expanded third-party information reporting strengthened monitoring.

Broader Fiscal Significance

- Tax mobilisation now draws from a wider taxpayer base.

- Strengthens revenue stability and fiscal sustainability.

- Reinforces taxation’s role in the formal economy.

Conclusion: India’s expanding taxpayer base alongside rising efficiency marks a durable strengthening of the direct tax system.