Syllabus: Devolution of powers and finances up to local levels and challenges therein.

Context

- The 16th Finance Commission, chaired by Dr. Arvind Panagariya, submitted its report for 2026–31.

- The Union government has accepted its tax devolution recommendations.

Constitutional Framework of Tax Devolution

- Article 270 governs distribution of net tax proceeds between Centre and States.

- Shared taxes include corporation tax, income tax, CGST, and Centre’s IGST share.

- Distribution is based on Finance Commission recommendations under Article 280.

- Cess and surcharge are excluded from the divisible pool.

- Divisible pool forms about 81% of gross tax revenue (2025–26).

Evolution of Vertical Devolution

- Till the 13th Finance Commission, States received 32% share in Central taxes.

- Transfers were tied to Centrally Sponsored Schemes with conditionalities.

- The 14th Finance Commission raised devolution to 42%, ending tied transfers.

- The 15th Finance Commission reduced it to 41% after J&K reorganisation.

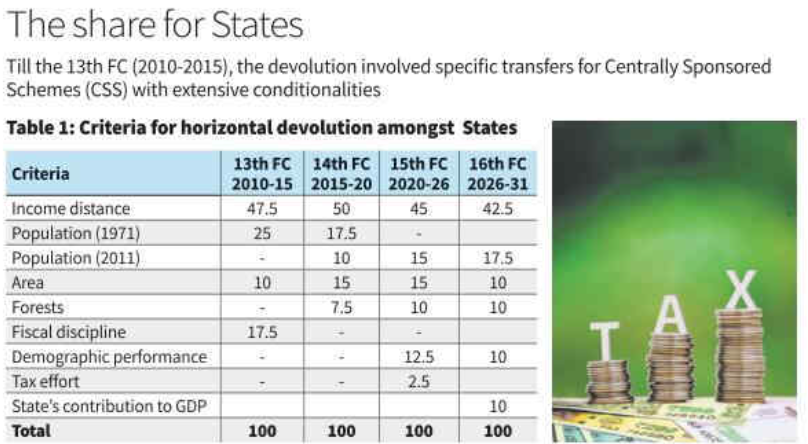

Horizontal Devolution Criteria

- Distribution among States uses equity, need, and efficiency indicators.

- Higher weightage given to income distance, population, and area.

- Efficiency factors include forests, demographic performance, and tax effort.

Demands Raised by States

- Vertical Devolution

- Eighteen States demanded increase from 41% to 50%.

- Some suggested 45–48% share.

- Many sought inclusion of cess and surcharge in the divisible pool.

- Some proposed capping Centre’s cess and surcharge levy.

- Horizontal Devolution

- Several States supported dominance of equity-based criteria.

- Many wanted reduced weight for income distance.

- Industrialised States sought inclusion of GDP contribution.

Key Recommendations of 16th FC

- Retained States’ vertical share at 41%.

- Cited Union needs for defence and infrastructure spending.

- Noted Union spending under CSS ultimately benefits States.

- Rejected capping or pooling of cess and surcharge.

New Horizontal Devolution Approach

- Added State contribution to GDP as a new efficiency criterion.

- Ensured gradual changes without drastic share redistribution.

- Southern and western States saw marginal share increase.

- Northern and central States witnessed marginal decline.

Additional Fiscal Observations

- Centre should reduce reliance on cess and surcharge.

- States must rationalise subsidies and power sector finances.

- Both levels should pursue public sector enterprise reforms.