Why in News: African nations are increasingly challenging China’s dominance in their mining sector through contract renegotiations, export bans on unprocessed minerals, and stricter environmental regulations to ensure greater local value addition and resource sovereignty.

Background

- Over the past two decades, China became a dominant player in Africa’s mining sector, often through infrastructure-for-resources deals.

- Criticism: Limited skills transfer, unfulfilled infrastructure promises, and disproportionate benefits to China.

- Current trend: African nations asserting agency, accountability, and economic sovereignty.

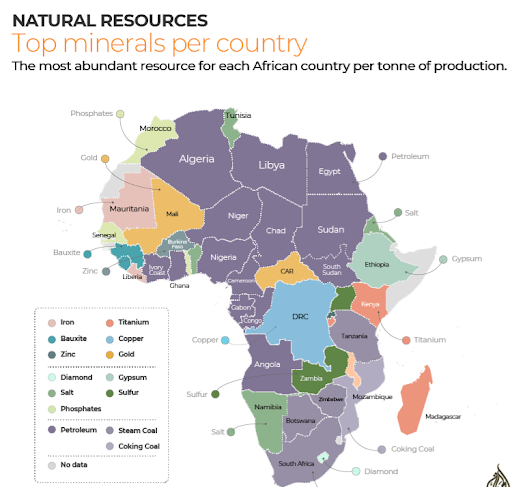

Africa’s Mineral Significance: Africa holds some of the world’s richest reserves of critical minerals.

- Democratic Republic of Congo (DRC): Produces ~80% of global cobalt (essential for rechargeable batteries).

Country-Specific Developments

DRC

- Produces 80% of world’s cobalt; China controls ~80% of DRC output via deals like Sicomines.

- Tax exemptions for Chinese firms cost ~$132M in 2024.

- Government renegotiating contracts, increasing state stake in joint ventures from 32% to 70%.

- Sale of Chemaf Resources to China’s Norin Mining cancelled after opposition.

Namibia

- Xinfeng Investments accused of bribery, failure to build promised lithium processing plants, poor labor conditions.

- 2023: Export ban on unprocessed lithium and other critical minerals.

Zimbabwe

- Zhejiang Huayou Cobalt invested $300M in lithium processing plant; concerns over benefit distribution.

- Export ban on unprocessed lithium since 2022.

- Environmental authorities blocked coal mining permits in Hwange National Park.

Zambia

- Acid spill from Chinese-owned copper mine contaminated Kafue River tributary.

Cameroon

- Opposition to Lobé-Kribi Iron Ore Project over environmental, health, and cultural threats.

Key Drivers of Resistance to China’s Mining Dominance in Africa

1. Economic Inequities

- Disproportionate Benefits: Local communities receive minimal gains compared to the value of extracted minerals (e.g., DRC’s cobalt exports).

- Revenue Losses: Tax exemptions to Chinese firms costing millions (e.g., $132M loss to DRC in 2024).

- Volatility Risks: Payments tied to market prices, reducing infrastructure investment during downturns.

2. Contractual & Governance Issues

- Opaque Agreements: Long-standing contracts, such as the Sicomines deal, criticised for lack of transparency.

- Renegotiations & Ownership Changes: Governments pushing for higher state stakes in joint ventures (e.g., DRC’s increase from 32% to 70%).

- Cancelled Sales: Deals blocked due to national opposition (e.g., Chemaf Resources sale).

3. Social & Labour Concerns

- Unfulfilled Promises: Failure to deliver skills transfer and promised infrastructure.

- Poor Working Conditions: Reports of hazardous workplaces and inadequate housing (e.g., Xinfeng Investments in Namibia).

- Lack of Local Capacity-Building: Continued export of raw materials without developing processing facilities.

4. Environmental Impact

- Ecosystem Threats: Projects encroaching on protected areas (e.g., Hwange National Park in Zimbabwe).

- Pollution Disasters: Acid spills contaminating major water sources (e.g., Kafue River in Zambia).

- Resource Overexploitation: Unregulated extraction causing long-term ecological harm.

5. Civil Society & Public Pressure

- Activist Campaigns: Groups like Congo Is Not for Sale demanding fairer terms.

- Public Outrage: Citizens calling for contract reviews and accountability.

- Community Opposition: Resistance to projects lacking adequate consultation (e.g., Lobé-Kribi project in Cameroon).

6. Strategic Policy Shifts

- Export Bans: Zimbabwe (2022) and Namibia (2023) prohibiting export of unprocessed lithium and critical minerals.

- Value Addition Requirements: Policies mandating local beneficiation and processing.

- Economic Sovereignty Focus: Aim to integrate into the global green economy as equal partners.

Implications

1. Economic

- Push for local processing and value addition.

- Risk of reduced foreign investment due to stricter regulations.

2. Political & Geopolitical

- Reassertion of resource sovereignty.

- Greater bargaining power in global green economy.

- Potential diversification of international partnerships.

3. Social

- Improved worker safety and housing standards.

- Enhanced community participation in decision-making.

- Risk of elite capture without transparency.

4. Environmental

- Stronger environmental protections (e.g., Hwange National Park).

- Promotion of sustainable mining practices.

- Need for remediation of past ecological damage (e.g., Kafue River).

5. Global Supply Chain

- Africa could move from raw material exporter to processing hub.

- Reduced Chinese dominance may reshape global mineral flows.

- Supports global green energy and EV industries.

Conclusion

African nations are challenging China’s mining dominance. This newly assertive approach seeks greater transparency, local economic development, and a strategic role in global supply chains—potentially shifting the balance of power away from China in the coming years.

UPSC Relevance

GS Paper 2: Governance, International Relations & Policy

- China-Africa relations and geopolitical influence.

Mains Practice Question

Q1: “In the context of Africa’s growing resistance to China’s mining dominance, discuss the economic, political, and environmental implications. How can African nations balance foreign investment with resource sovereignty?”