PRELIMS

Healthocide:

Why in News: Researchers from the American University of Beirut coined the term “healthocide” in BMJ Global Health (Aug 2025)

Origin: Coined by researchers from American University of Beirut (Lebanon) in BMJ Global Health (Aug 5, 2025).

Meaning: Refers to deliberate, large-scale destruction of entire health ecosystems in conflict zones.

Includes: killing clinicians, bombing hospitals, blocking ambulances, dismantling supply chains.

Comparison: Framed as akin to genocide → destruction of a collective good essential to life and dignity.

Purpose: To galvanise the medical community; demands stronger legal protections for healthcare in conflict zones.

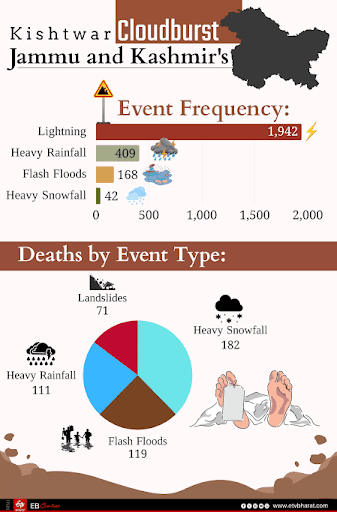

Extreme Weather Events in Jammu & Kashmir

Why in News: A flash flood in Kishtwar district, J&K (Chasoti village near Machail Mata temple) killed at least 65 people and left over 50 missing.

Trend: Sharp rise in extreme weather events in J&K; linked to global warming & climate change.

Major Causes:

- Rising Temperatures – Western Himalayas are warming 2x faster than the Indian subcontinent.

- Shrinking Glaciers – unstable glacial lakes → risk of Glacial Lake Outburst Floods (GLOFs).

- Changing Western Disturbances – now beyond winter; Arabian Sea heating → more moisture, heavier rainfall.

- Topography – mountain terrain + orographic rainfall → prone to floods & landslides.

Human Impact:

- Districts worst-hit: Kishtwar, Anantnag, Ganderbal, Doda.

- Flash floods: highest fatalities.

- Heavy rain & snow: deadliest weather events overall.

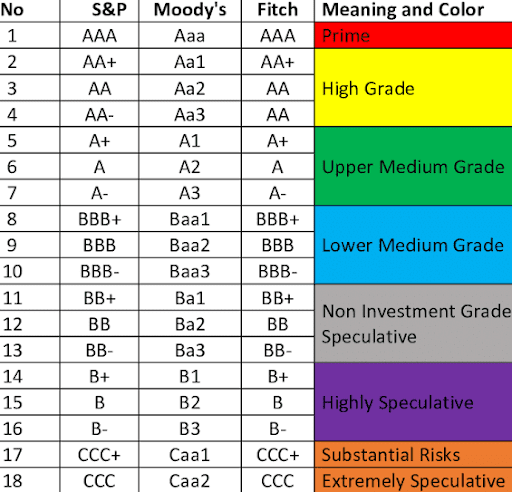

India’s Sovereign Credit Rating Upgrade

Why in News: S&P Global Ratings has upgraded India’s sovereign credit rating from BBB- to BBB after 14 years, citing steady economic growth, fiscal consolidation, and resilience, making borrowing cheaper and boosting investor confidence.

India’s S&P Rating Upgrade

Agency: S&P Global Ratings

Upgrade: From BBB- to BBB (first upgrade in 14 years, since 2011).

Significance: Moves India from the lowest investment grade closer to mid-level; lowers cost of borrowing, improves investor confidence.

Reasons for Upgrade

- Steady economic improvement despite Covid shock.

- Fiscal discipline: Fiscal deficit consistently reducing; below 3% in 2007-08, pandemic pushed it to ~9.2% (2020-21), now declining.

- Debt-to-GDP ratio: Projected to fall from 81% (2020-21) to ~75% by 2030-31.

- Nominal GDP growth: Among world’s fastest growing economies (~11.5% average nominal growth over last decade).

- Resilient growth: India remains one of the strongest-performing economies, despite global slowdown.

Rating Scale Context

- Current position: India at BBB, stable outlook.

- Next step: BBB+, then A category.

- Peers: India with BBB rating joins countries like Italy, Indonesia, Philippines.

- A-rated group: Includes Cyprus, Poland, Malaysia; richest = Australia, Canada, Denmark, Germany.

- Best rating countries: U.S., downgraded to AA+ in 2011 (first downgrade in history).

Implications

Positive:

- Opens the door for global funds inflow.

- Lowers cost of sovereign and corporate borrowing.

- Encourages private investment & growth.

Challenges:

- Maintaining fiscal discipline.

- Managing high debt & interest costs.

- Need for structural reforms to sustain growth.

Credit Rating – Static Information

Definition:

A credit rating is an independent assessment of a borrower’s (sovereign, corporate, or financial institution) ability to repay debt, expressed through letter grades.

Purpose:

- Helps investors assess credit risk.

- Determines cost of borrowing (higher rating → lower interest rates).

- Influences capital inflows and investor confidence.

Animal Blood Bank Network

Why in News: The Centre has released draft Guidelines/SOPs for Blood Transfusion & Blood Bank for Animals in India to establish a National Veterinary Blood Bank Network (N-VBBN) for standardising animal blood banking and transfusion.

Draft Guidelines for Animal Blood Bank

Prepared by:

- Department of Animal Husbandry & Dairying.

Need:

- India: 536.76 million livestock (20th Livestock Census 2019).

- Companion animals: ~125 million.

- Livestock sector: ~30% of Agri GVA & 5.5% of Indian economy.

- Lack of national standards → dependence on hospital-based donors.

Donor Criteria:

- Clinically healthy, disease-free.

- Dogs: 1–8 yrs, ≥25 kg; Cats: 1–5 yrs, ≥4 kg.

- Fully vaccinated, esp. rabies.

- Female donors not pregnant/lactating.

National Veterinary Blood Bank Network (N-VBBN):

- Digitally integrated donor registry.

- Real-time inventory management.

- Helpline + online portal linking clinics, hospitals, donors.

- Standardised practices & adverse reaction logs.

Hosting Centres:

- Veterinary colleges & universities.

- Referral hospitals & polyclinics.

- Large diagnostic centres.

- Govt multi-speciality animal hospitals.

Related-Party Transactions (RPT)

Why in News: Value of RPTs in India has fallen below pre-pandemic levels.

Definition:

- Deal/arrangement between two entities with a pre-existing business relationship or common interest.

- Legal but can be misused to benefit promoters at the cost of minority shareholders.

Usage:

- Buying/selling of goods, raw materials, services among group companies.

- Reported in Balance Sheet (assets, liabilities, equity) & Profit-and-Loss Statement (net sales).

Regulation:

- Regulated by: SEBI.

- Law: Companies Act, 2013.

- Rule: SEBI mandates shareholder approval for RPTs crossing a defined threshold.

Recent Regulation Change:

- SEBI consultation paper proposes easing minimum threshold for shareholder approval.

- Aim: Reduce compliance burden for large-turnover companies.

Sector-wise Impact:

- High RPT usage: Steel, Real Estate, Pharmaceuticals.

- Real Estate: RPTs = ~17% of assets.

- Multiple sectors: RPTs = ≥20% of net sales.