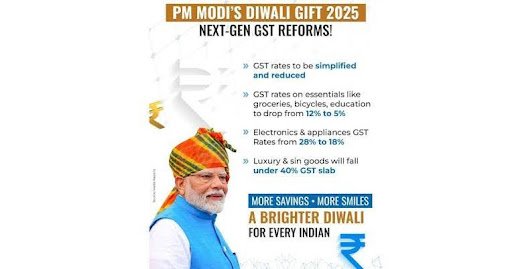

Why in News: The Centre has proposed next-generation GST reforms, rationalising the tax structure into two main slabs (5% and 18%) with higher rates on sin/luxury goods. While aimed at simplification and boosting investment, the move may cause short-term revenue losses, raising the debate on whether States should be compensated.

Introduction

- The Centre’s proposal to rationalise GST slabs into a two-tier structure (5% and 18%) is expected to lower the average tax incidence to around 10%.

- While this reform simplifies taxation and boosts competitiveness, it raises the question of whether States should be compensated for short-term revenue losses.

Arguments in Favour of Compensation

- Unequal Impact: Manufacturing-heavy States like Maharashtra, Karnataka, Tamil Nadu face sharper revenue losses compared to agrarian States.

- Federal Compact: GST subsumed States’ taxation powers; compensation ensures fiscal balance.

- Cooperative Federalism: Maintaining trust and consensus in GST Council requires revenue protection for States.

- Precedent: States were compensated for 5 years after GST rollout, setting expectations of transitional support.

- Welfare and Developmental Needs: States rely heavily on GST for funding welfare and infrastructure.

Arguments Against Compensation

- End of Transition: The 5-year compensation period (2017–22) was a defined arrangement and has ended.

- Fiscal Burden on Centre: Indefinite compensation is unsustainable given deficit pressures.

- Mature Tax System: GST collections have stabilised (~₹1.6–1.7 lakh crore monthly).

- Moral Hazard: Regular bailouts discourage States from improving efficiency and diversifying revenues.

- Long-term Gains: Lower rates improve compliance, widen tax base, and attract investment.

Challenges

- Revenue Volatility: Immediate fiscal stress for industrial States.

- Asymmetric Impact: Uneven distribution of GST benefits and losses.

- Trust Deficit: Risk of friction between Centre and States if concerns are ignored.

- Consensus in GST Council: Disagreements could stall key reforms.

Way Forward

- Time-bound Transitional Support for States with sharper revenue loss.

- GST Contingency Fund financed partly through cess on sin/luxury goods.

- Strengthen Compliance via digitalisation, e-invoicing, and widening tax base.

- Diversify State Revenues through property tax, excise, and investment-led growth.

- Consensus-driven Reforms in GST Council to preserve cooperative federalism.

Conclusion

While permanent compensation is fiscally unsustainable, ignoring asymmetric losses undermines federal trust. A balanced, transitional mechanism — short-term support combined with long-term revenue strengthening — is essential for sustaining GST reforms and preserving the spirit of cooperative federalism.

UPSC Relevance

GS Paper II (Governance, Federalism)

- Issues and challenges of fiscal federalism and cooperative federalism.

GS Paper III (Economy)

- GST reforms, revenue sharing, and fiscal challenges.