Shift in Fiscal Policy Framework

- Fiscal policy now prioritises debt-to-GDP ratio over fiscal deficit-GDP as primary anchor.

- New rule targets around 50% debt-GDP ratio by 2031, higher than FRBM’s 40% benchmark.

- Approach reflects a modified “sound finance” framework, allowing relatively higher public debt.

Deficit Reduction Strategy for FY27

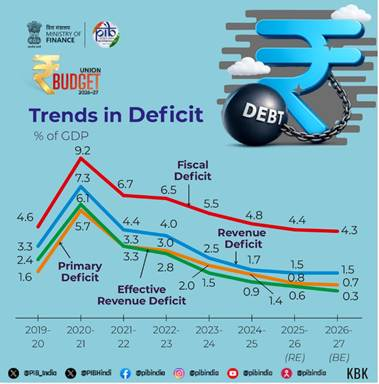

- Primary deficit reduced from 0.8% to 0.7% of GDP between FY26 and FY27.

- Fiscal deficit lowered from 4.4% to 4.3% of GDP in FY27.

- Consolidation pace is less severe than post-FY22 adjustments, due to expanded fiscal space.

Revenue Trends and Non-Debt Receipts

- Government’s non-debt receipts share falls to 9.3% of GDP in FY27.

- Decline driven by 0.3 percentage point fall in indirect taxes and GST.

- Lower receipts constrain expenditure capacity under deficit-reduction commitments.

Expenditure Composition and Adjustment Burden

- Total expenditure-GDP ratio declines from 13.9% in FY26 to 13.6% in FY27.

- Capital expenditure-GDP ratio remains stable at 3.1%, reflecting growth-oriented prioritisation.

- Adjustment occurs mainly through reduced revenue expenditure rather than capital outlays.

Impact on Development and Rural Spending

- Development expenditure share falls from 6.1% to 5.7% of GDP in FY27.

- Rural development and agriculture expenditure declines from 1.5% to 1.2% of GDP.

- Revenue spending on rural employment programmes accounts for major reduction.

Demand and Growth Implications

- Positive demand impact of lower indirect taxes and GST is offset by spending cuts.

- Reduced agricultural and rural expenditure dampens overall demand stimulus.

- Growth support increasingly relies on capital expenditure multipliers.

Key Policy Concerns Highlighted

- Corporate investment-capital ratio remains weak amid global uncertainty and export slowdown.

- Fiscal strategy offers limited stimulus for private investment revival.

- Distributional burden of consolidation falls on development and agricultural sectors.

- Corporate tax-GDP ratio remains unchanged from pre-COVID levels, raising equity concerns.