Context and Reference to Budget 2025–26

- Budget 2026–27 assessed against outcomes of the previous middle-class tax cut strategy.

- Government expected higher compliance and rising incomes to offset reduced tax rates.

- The anticipated revenue buoyancy did not materialise as initially projected.

Tax Revenue Performance and Shortfalls

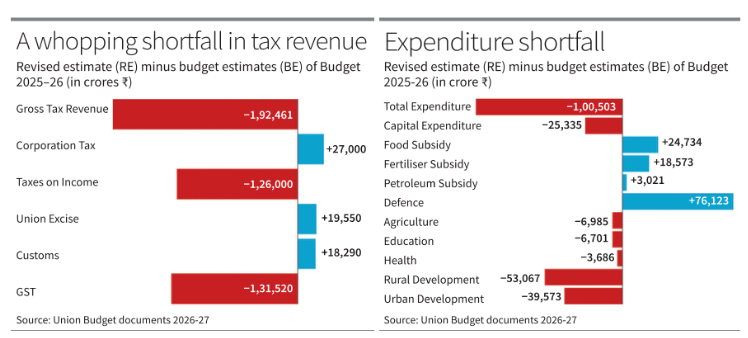

- Income tax collections fell short of estimates by ₹1.26 lakh crore in Revised Estimates.

- Goods and Services Tax collections showed a further shortfall of ₹1.31 lakh crore.

- Corporate tax and excise duty performance marginally reduced the overall gross tax gap.

- Total gross tax revenue shortfall remained around ₹1.92 lakh crore.

Impact on Expenditure and Development Priorities

- Fiscal deficit rules link expenditure levels directly to realised tax collections.

- Revenue shortfalls triggered across-the-board expenditure reductions.

- Capital expenditure, agriculture, education, health, and urban development faced budgetary cuts.

- Reduced spending affected employment generation, income support, and essential public services.

External Risks and Macroeconomic Uncertainty

- India faces current account surplus with the United States and deficit with China.

- Potential export decline from U.S. tariff escalation could worsen external balance.

- Economic Survey assigned 10% probability to external sector deterioration.

- Budget planning assumed continuity of stable global conditions.

Demand-Side Strategy and Employment Concerns

- Budget emphasises fiscal prudence, supply-side measures, and MSME credit guarantees.

- Employment outcomes, especially among youth and urban women, remain weak.

- Corporate investment growth continues to be subdued despite repeated policy approaches.

- Public capital expenditure prioritised infrastructure over development-oriented spending.

Policy Gaps and Missed Opportunities

- Employment-intensive sectors like education, health, and agriculture received limited emphasis.

- Welfare and development spending noted for strong multi-round demand generation potential.

- Environmental concerns, particularly urban pollution, received no specific budgetary focus.

- Absence of a demand-led strategy raises questions on long-term employment sustainability.