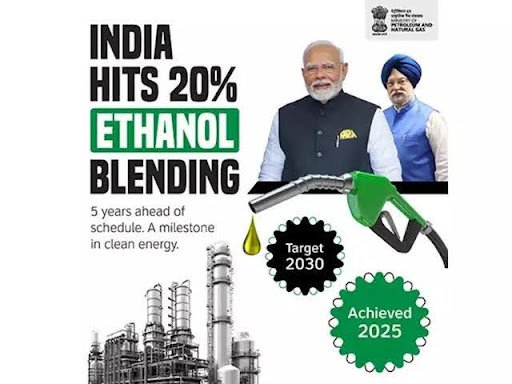

Why in News: India has achieved 20% ethanol blending (E20) in petrol in 2025, five years ahead of schedule under the National Policy on Biofuels.

Introduction

- India has achieved 20% ethanol blending (E20) in petrol in 2025, five years ahead of the target set under the National Policy on Biofuels.

- While this achievement is touted as a major step in reducing oil import dependence, cutting emissions, and enhancing farmer incomes, it has also raised concerns.

Impact of Ethanol Blending

- Economic Gains: Saved over ₹1.40 lakh crore in foreign exchange since 2014-15 through reduced oil imports.

- Agricultural Benefits: Farmers received more than ₹1.20 lakh crore since FY15 from ethanol procurement.

- Emission Reductions: Claimed reduction of 700 lakh tonnes of CO₂ emissions.

- Industry Growth: Sugarcane-based ethanol production rose from 40 crore litres (2014) to nearly 670 crore litres (2024).

- Diversification of Feedstock – Use of rice and maize along with sugarcane for ethanol production.

- Rural Development – Strengthens rural economy through demand for crops and related industries.

Concerns and Challenges

1. Consumer Resistance

- LocalCircles survey: 2 in 3 vehicle owners opposed E20; only 12% supported.

- Concerns: drop in mileage, higher maintenance, incompatibility of older vehicles.

NITI Aayog suggested tax incentives to compensate consumers.

2. Water-Intensive Agriculture

- Sugarcane requires 60–70 tonnes water per tonne; optimal rainfall (1500–3000 mm) absent in most regions.

- Over-extraction of groundwater reported in Maharashtra’s sugarcane districts (CGWB, 2023).

- Contributes to land degradation; 30% of India’s land degraded (Desertification Atlas 2021).

3. Food vs Fuel Trade-off

- Rice diversion to ethanol at record levels (5.2 million MT).

- Corn imports rose six-fold (9.7 lakh tonnes in 2024–25 vs 1.37 lakh tonnes previous year) due to diversion.

- Risks impacting food security and raising food inflation.

4. Unequal Benefit Sharing

- Despite huge forex savings and oil price declines (65% drop since 2022–23), PSU oil companies passed only a 2% cut in petrol prices.

5. Global Trade Pressure

- The U.S. labelled India’s ethanol import restrictions as a “trade barrier” (2025 National Trade Estimate Report).

- Pressure to allow U.S. ethanol imports could undermine India’s domestic ethanol ecosystem.

6. Slower EV Transition

- EV sales only 7.6% in 2024, far behind China, EU, and U.S.

- Target of 30% EV penetration by 2030 requires >22% annual growth.

- Barriers:

- Dependence on Rare Earth Elements (REEs) like magnets for EVs, mostly supplied by China.

- Supply disruptions (Maruti Suzuki scaled down EV targets due to REE shortage).

- Risk of over-reliance on coal-based electricity unless renewables expand.

Way Forward

1. Balanced Feedstock Policy – Reduce over-dependence on sugarcane; incentivise second-generation biofuels (crop residues, waste biomass).

2. Consumer Compensation – Tax rebates/subsidies for E20 users to address mileage drop and maintenance cost.

3. Water-Smart Agriculture – Promote drip irrigation, crop rotation, and region-specific ethanol crops to reduce groundwater stress.

4. Pricing Transparency – Ensure benefits of forex savings are shared with consumers, not just PSU dividends.

5. Trade Diplomacy – Defend domestic industry against U.S. import pressure while exploring tech partnerships.

6. Strengthen EV Push – Secure rare earth supplies via diplomacy and domestic exploration; link EV expansion with renewable energy growth.

7. Holistic Transition – Use ethanol as a bridge fuel, but accelerate EV adoption for deep decarbonisation.

Conclusion

Ethanol must be seen as a transitional strategy, complemented by systemic reforms in agriculture, pricing, trade policy, and an accelerated EV roadmap to achieve truly sustainable mobility.

UPSC Relevance

GS Paper III (Economy & Environment):

- Energy security: reducing oil import bill through ethanol substitution.

- Agriculture & sustainability

Mains Practice Question

Q. India has achieved its 20% ethanol blending target ahead of schedule, but the policy raises economic, environmental, and consumer-related concerns. Discuss the positive impacts of ethanol blending and critically analyse the challenges India faces in making it a sustainable transition fuel. (250 words)