Context

- The Economic Survey 2025–26 supports delaying strict FRBM fiscal targets for the Centre.

- Rationale given is need for policy flexibility amid volatile geopolitical and geoeconomic conditions.

- Survey simultaneously flags deteriorating fiscal health of States due to revenue and expenditure pressures.

Centre’s Fiscal Performance

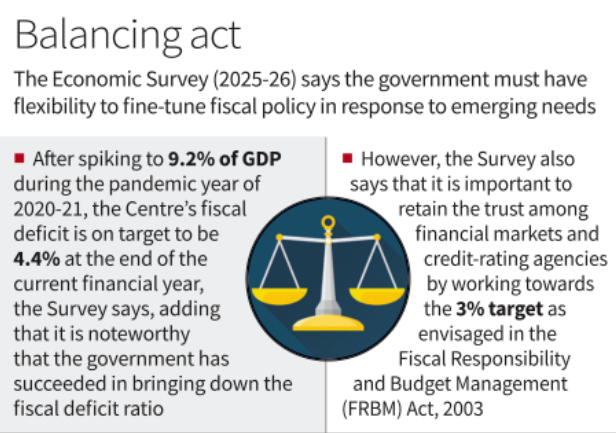

- Centre’s fiscal deficit peaked at 9.2% of GDP in 2020–21 during the pandemic.

- Deficit is projected to decline to 4.4% of GDP in FY26.

- This aligns with commitment to halve the pandemic-era deficit within five years.

- Survey notes emphasis on improving expenditure quality alongside higher capital spending.

- Fiscal consolidation achieved without legislative compulsion under FRBM framework.

FRBM Framework and Credibility Concerns

- FRBM Act target of 3% deficit by March 2020 has been repeatedly deferred.

- Survey acknowledges public perception demanding restoration of strict fiscal discipline.

- Only one successful achievement of the 3% target since 2003 is noted.

- Repeated slippages have weakened India’s fiscal credibility in financial markets.

- Post-COVID consolidation restored trust among investors and credit-rating agencies.

- Survey stresses importance of maintaining this restored credibility.

States’ Worsening Fiscal Position

- States in revenue surplus declined from 19 in 2018–19 to 11 in 2024–25.

- Collective revenue deficit rose from 0.1% to 0.7% of GDP.

- Survey links deterioration to lower revenues and rising expenditure, including cash transfers.

- Warns that persistent deficits constrain long-term fiscal sustainability at subnational levels.

Key Policy Implication

- Calls for balanced fiscal flexibility for the Centre.

- Simultaneously urges greater fiscal discipline and revenue strengthening among States.

- Full form: Fiscal Responsibility and Budget Management Act, 2003

- Objective: Ensure fiscal discipline, inter-generational equity, and long-term macroeconomic stability.

- Focus: Guide Central Government towards sustainable deficit and debt management.

- CAG Role: Mandatory annual compliance audit of FRBM provisions.

- Mandatory Budget Statements (Laid Before Parliament)

- Macro-Economic Framework Statement: Economic outlook and assumptions.

- Medium-Term Fiscal Policy Statement: Fiscal targets and rolling projections.

- Fiscal Policy Strategy Statement: Policy stance and fiscal priorities.

- Key Fiscal Targets

- Fiscal Deficit

- Original target: ≤ 3% of GDP

- Deadline: 31 March 2021

- Actual (2023–24, CAG): 5.32% of GDP

- Revised path: < 4.5% of GDP by FY 2025–26

- Public Debt Limits

- General Government (Centre + States): ≤ 60% of GDP

- Central Government: ≤ 40% of GDP

- Deadline: End of FY 2024–25

- Current (2023–24):

- Central Government: 57% of GDP

- General Government: 81.3% of GDP

- Additional Guarantees

- Cap: ≤ 0.5% of GDP per year

- Linked to: Consolidated Fund of India

- Fiscal Deficit

- FRBM Amendment, 2018:

- Removed targets for Revenue Deficit and Effective Revenue Deficit.

- Shifted focus to debt and fiscal deficit anchoring.