Why in News: The Karnataka Platform Based Gig Workers (Social Security and Welfare) Ordinance, 2025 is a welcome move. However, the provisions for calculating the welfare cess reveal serious shortcomings that may undermine its effectiveness.

Definition: The gig economy refers to a labor market that is driven by short-term contracts, freelance assignments, or on-demand work, typically facilitated through digital platforms, as opposed to traditional full-time or long-term employment.

Range of Employment: Gig work spans a wide variety of sectors and services, such as:

- Ride-sharing and delivery services (e.g., Uber, Zomato)

- Freelance content creation (e.g., writing, graphic design)

- Coding and software development

- Tutoring and teaching online

- Managing short-term rentals

- Digital marketing and social media management

Legal Status in India: India currently does not have exclusive legislation for gig workers.

However, gig workers are brought under certain protections through:

- Code on Social Security, 2020 – recognizes gig and platform workers as unorganized workers.

- Code on Wages, 2019 – aims to ensure minimum wage coverage to all categories of workers.

Karnataka Gig Workers Ordinance, 2025 – Key Highlights

Welfare Fee

- Platforms must pay 1–5% welfare fee per transaction with gig workers.

- Paid quarterly, counted under Code on Social Security, 2020.

- Annual reconciliation allowed.

Payment & Monitoring System

- Transactions tracked via Payment and Welfare Fee Verification System (PWFVS).

- Monitored by the upcoming Karnataka Gig Workers Welfare Board.

Welfare Fund

- Funded by platforms, workers, and government grants.

- Covers healthcare, income security, maternity, old age, and disability benefits.

- Special focus on women and disabled workers.

Registration & ID

- All platforms must register with the Board.

- Workers receive a unique ID valid across platforms.

Worker Rights & Contracts

- Contracts must mention payout terms, task refusal rights.

- Termination only with 14-day notice (except violence cases).

Timely Payments & Transparency

- Payments must be disbursed without delays (daily/weekly/biweekly/monthly).

- Deductions must be disclosed in invoices.

Algorithmic Accountability

- Platforms must explain automated decision systems.

- No discrimination based on gender, caste, religion, etc.

Shortcomings in Welfare Cess Calculation

1. Use of ‘Payout’ Instead of ‘Turnover’ as Base

- The ordinance defines cess as 1–5% of the payout to gig workers per transaction.

- This deviates from the Central Social Security Code, which mandates 1–2% of turnover (with a 5% cap on worker payments).

- Since payout < turnover, even the maximum 5% on payout may not meet the minimum 1% of turnover requirement.

2. Risk of Minimal Contributions

- In practice, cess rates often settle at the lowest permissible level (e.g., 1% in construction welfare cess).

- This trend could result in 1% on payout becoming the norm, drastically reducing total welfare contributions.

3. Example of Zomato (FY 2024)

- Revenue: ₹7,790 crore; Payout: ₹3,900 crore.

- 2% cess on payout = ₹78 crore → just 1% of turnover.

- With platforms shifting towards merchandising or in-house services, the payout-to-turnover ratio may shrink, further lowering cess yields.

4. Minimal Customer/Employer Burden

- A 5% cess on ₹100 order = ₹0.50 — negligible for customers.

- Even at this rate, platform contribution is less than a third of what formal sector employers pay under EPF and ESI.

5. Exclusion Risk Under Subscription Models

- Platforms like Namma Yatri use a subscription model (no per-ride payout; drivers keep full fare).

- Since payout = ₹0, such workers could be excluded from the cess and welfare system.

Proposed Solution

- For platforms using subscription models, cess could be charged as a percentage of total transaction value (e.g., 2%) and collected from the customer fee.

- The platform would act merely as a cess collection intermediary.

- The cess amount could be transferred to the Payment and Welfare Fee Verification System outlined in the ordinance.

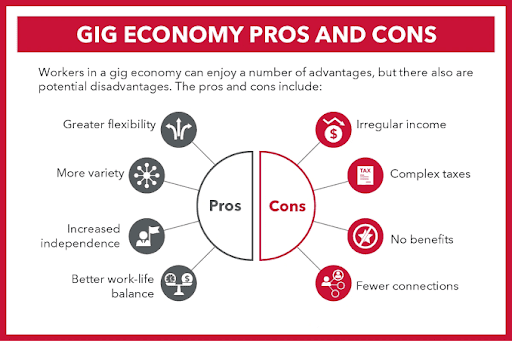

Key characteristics of the gig economy

- Flexibility & Autonomy: Workers choose when, where, and how much they work.

- Project-Based Work: Engagement is on short-term tasks or specific projects.

- Self-Employment: Gig workers are usually independent contractors, not salaried employees.

- Lack of Job Security: No guaranteed income or continuous employment due to the temporary nature of gigs.

Challenges Faced by Gig Workers

- No formal employee benefits like provident fund, insurance, or paid leave.

- Income instability and lack of minimum wage protection.

- Limited bargaining power and weak dispute resolution mechanisms.

- Ambiguity in employer-employee relationship, especially in platform-based work.

Steps Taken by India for Gig Workers

1. Social Security Code, 2020

- Recognizes gig workers as a distinct category of workers.

- Seeks to extend social security benefits such as health insurance, provident fund, and maternity benefits to gig and platform workers.

2. e-Shram Portal

- Launched as a national database for unorganized sector workers, including gig and platform workers.

- Facilitates easier delivery of social security schemes and benefits to registered workers.

3. Union Budget 2025-26

- Announced provisions for issuance of identity cards to gig workers.

- Expanded healthcare coverage under Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB-PMJAY) to include gig workers.

4. Rajasthan Platform-Based Gig Workers Act, 2023

- India’s first state-level legislation specifically dedicated to the rights and welfare of gig workers.

- Serves as a model for other states to frame gig worker protections.

UPSC RELEVANCE

GS Paper 3 (Economy & Technology)

- Influence of digital platforms and technology on employment structures.

GS Paper 2 (Governance, Social Justice & Labour Welfare)

- Need for legal reforms like the Social Security Code, state-level legislation, and welfare schemes.

Mains Practice Question

The gig economy has transformed traditional employment but exposed workers to new vulnerabilities.” Discuss the social challenges faced by gig workers in India.