Syllabus: Inclusive growth and issues arising from it

Context

- Recent RBI and Budget data reveal stable growth, but emerging financial stress within households.

- Growth appears supported by lower savings and higher borrowing, transferring economic risks onto households.

Aggregate Indicators and Hidden Fragility

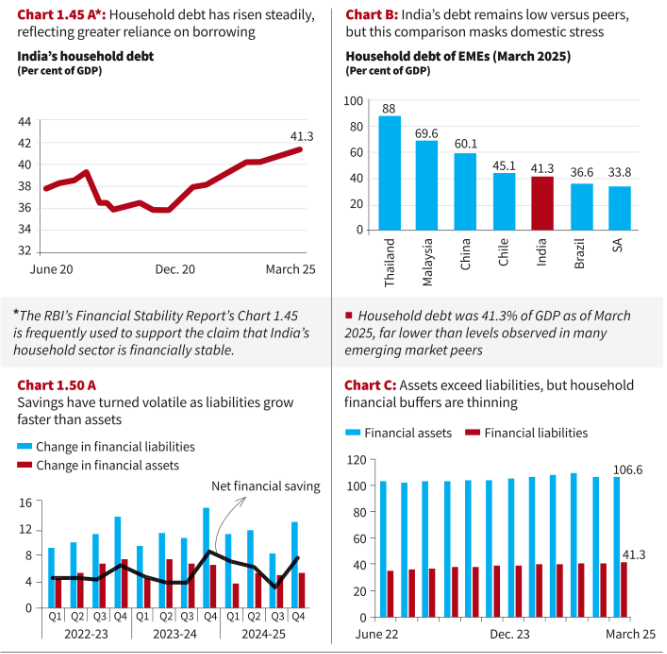

- RBI Financial Stability Report 2025 shows household debt at 41.3% of GDP.

- Debt levels remain lower than peers like China, Malaysia, and Thailand.

- Debt rose gradually from 36% of GDP in mid-2021 to current levels.

- Debt-to-GDP ratios indicate scale of borrowing, not households’ repayment capacity.

Income, Consumption, and Credit Dynamics

- RBI Annual Report 2024–25 highlights uneven real income growth, especially outside formal employment sectors.

- Consumption remains steady despite weak income expansion, prompting reliance on borrowing.

- Credit increasingly fills income–expense gaps, rather than financing long-term asset creation.

- Moderate debt becomes risky when it substitutes for savings and income growth.

Household Balance Sheet Trends

- Financial liabilities stood at 41.3% of GDP in March 2025.

- Gross household financial assets reached 106.6% of GDP, maintaining net wealth.

- Flow data shows volatile net financial savings, signalling underlying financial pressure.

- Net savings recovered to 7.6% of GDP in late 2024–25, after compressing to 3–4%.

- Faster liability accumulation than asset growth drives savings volatility.

Fiscal Structure and Risk Transfer

- States prioritise capital expenditure, limiting revenue spending for income support.

- Committed expenditures consume 30–32% of State revenues, reducing countercyclical capacity.

- Union Budget 2025–26 allocates ₹11.2 lakh crore to capital expenditure.

- Infrastructure investment boosts growth, but does not stabilise short-term household incomes.

Macroeconomic Risks and Outlook

- Private consumption forms nearly 60% of GDP, making households key economic stabilisers.

- Rapid expansion of unsecured retail credit sustains consumption on weaker financial buffers.

- Volatile savings and rising liabilities reduce households’ shock-absorption capacity.

- Economic slowdowns or interest rate rises may trigger abrupt consumption retrenchment.

Policy Implications for Budget 2026

- Fiscal strategy should enhance disposable incomes and labour-intensive employment.

- Growth must rebalance towards income security, savings restoration, and household resilience.