Why in News: The Income Tax Bill, 2025, passed in the Parliament, seeks to replace the Income Tax Act, 1961, which had become outdated, overly complex, and prone to misuse.

Why was a New Law Needed?

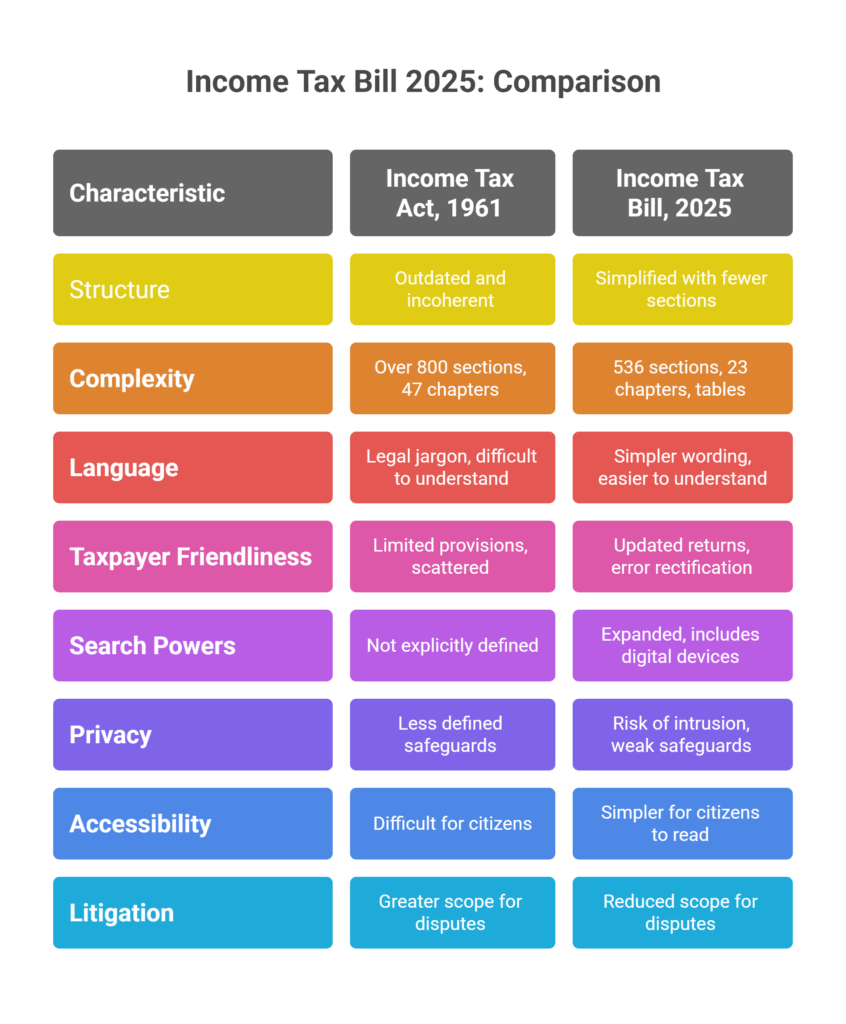

1. Outdated framework: Income Tax Act, 1961 had undergone countless amendments, losing coherence.

2. Legal complexity: Over 800 sections and 47 chapters made it confusing for taxpayers.

3. Discretionary powers: Allowed excessive room for interpretation by officials, leading to harassment.

4. Need for clarity: Common citizens, small businesses, and startups needed simple, plain-language law.

5. Ease of compliance: Modern economy requires predictable, transparent taxation to improve India’s business climate.

Key Features of the New Bill

1. Structural Simplification

- Chapters reduced: 23 (from 47).

- Sections reduced: 536 (from 819).

- More tables (57 from 18) and formulae (46 from 6) to aid clarity.

2. Language: Legal jargon reduced, simpler wording used.

3. Technical Rationalisation

- MAT (Minimum Alternate Tax) and AMT (Alternate Minimum Tax) separated.

- Focus on simplification, not on tax rates/slabs (which remain subject to Budget announcements).

Taxpayer-Friendly Provisions

- Updated returns allowed up to 4 years from end of assessment year without penalty.

- Reduced reopening of assessments: Now capped at 5 years (earlier much longer).

- Error rectification: Genuine mistakes can be corrected with no tax incidence.

- Codification of beneficial provisions: Earlier scattered or case-law based, now clearly legislated.

- Ease of compliance: Citizens get certainty, businesses get predictability in long-term planning.

Problematic Provisions

- Expanded search powers: Tax officials can demand passwords to personal devices and accounts.

- No limits: Scope of “electronic information” undefined – can include emails, social media, private messages.

- Access override: Officials authorised to bypass or override system access codes.

- Risk of misuse: May lead to harassment, invasion of privacy, beyond financial data.

- Weak safeguards: No clear checks on proportionality or independent oversight of such intrusive powers.

Justification by Government

- Digital economy reality: Financial information increasingly flows via emails, messaging apps, cloud storage.

- Evasion risk: Black money, benami dealings, and hawala networks often use encrypted channels.

- International best practices: Many countries allow tax authorities access to digital records during searches.

- Select Committee’s acceptance: Despite some dissent, committee endorsed inclusion of these powers.

- Balancing need: Government argues privacy cannot override state’s interest in curbing tax evasion.

Implications

Positive

- Greater accessibility: Law becomes simpler for citizens to read and understand.

- Reduced litigation: Clearer provisions reduce scope for disputes.

- Ease of doing business: Simplified compliance fosters investor confidence.

- Taxpayer rights: Ability to update returns improves fairness.

- Transparency: Tables and formulae codify calculations.

Negative

- Privacy intrusion: Expanded powers risk violation of Right to Privacy (Puttaswamy judgment).

- Potential misuse: Officials may demand irrelevant personal data.

- Fear factor: Harassment concerns may continue despite simplification.

- Trust deficit: Citizens may view law as tilted towards enforcement, not facilitation.

- Investment climate: Foreign investors wary of excessive surveillance powers.

Conclusion:

Going forward, strong safeguards, accountability mechanisms, and independent oversight are needed to balance the state’s interest in preventing tax evasion with the citizen’s right to dignity and privacy.

UPSC RELEVANCE

GS Paper III (Economy)

- Indian Economy and issues relating to planning, mobilization of resources, growth, development and employment

Mains Practice Question

Q. “Simplification of tax laws is a precondition for ease of doing business and inclusive growth in India.” Analyse in context of the Income Tax Bill, 2025.