Syllabus: Infrastructure: Energy, Ports, Roads, Airports, Railways etc.

Context: Emerging Stress in Aviation Sector

- India’s aviation sector faced multiple operational disruptions and safety incidents recently.

- Major airlines reported sharp profit declines and rising passenger dissatisfaction.

- Events included the Ahmedabad crash (June 2025), cancellations, and prolonged delays.

- December 2025 disruption exposed deeper system-wide operational fragilities.

Scale and Growth of Indian Aviation

- India is the world’s third-largest domestic aviation market.

- Sector operates over 840 aircraft annually.

- Carries more than 350 million passengers each year.

- Rapid expansion has stretched infrastructure and workforce capacity.

Pilot Shortage and Workforce Stress

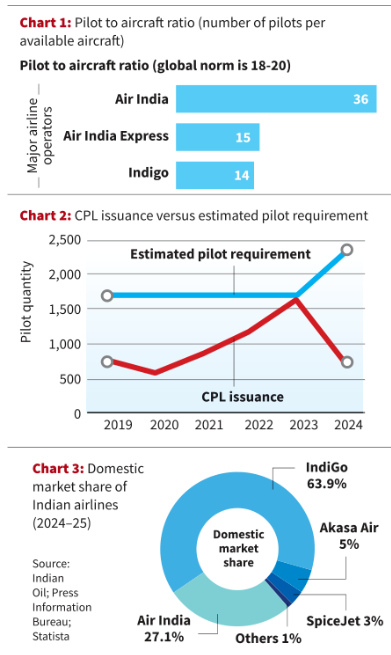

- IndiGo operated 360+ aircraft with 5,038 pilots.

- Pilot-to-aircraft ratio stood at 14, below global benchmark 18–20.

- New Flight Duty Time Limitation (FDTL) rules tightened operations.

- Night flights reduced; rest periods extended; flying hours capped.

- India needs 7,000 pilots (2024–26); demand may reach 30,000 decade-wise.

- DGCA issued only 5,700 CPLs (2020–24).

- Trainer shortages, simulators, and high costs restrict supply.

- Around 236 foreign pilot approvals issued in 2025 as stopgap.

Regulatory and Oversight Gaps

- Nearly half of DGCA technical posts remain vacant.

- Disruptions managed via schedule exemptions, not strict enforcement.

- Indicates fragile regulatory and monitoring capacity.

Market Concentration and Duopoly Risks

- IndiGo holds 63–65% domestic passenger share.

- Air India Group accounts for 27–28% share.

- Together control nearly 90% of domestic aviation market.

- IndiGo alone operates on 60.4% routes as sole carrier.

- Disruptions reduce connectivity instead of redistributing passengers.

Entry of New Regional Airlines

- NOCs issued to Shankh Air, Al Hind Air, FlyExpress (Dec 2025).

- Aim to enhance regional connectivity and underserved routes.

- Linked to UDAN scheme expansion.

- UDAN operationalised 625 routes, 85 airports by 2025.

Structural Risks for New Entrants

- Past airline failures include Kingfisher, Jet Airways, Go First.

- Causes: high costs, weak demand, poor management, infrastructure gaps.

- ATF price volatility tied to global markets remains major risk.

Safety and Systemic Concerns

- DGCA issued 19 safety violation notices by late 2025.

- Violations included FDTL breaches and equipment lapses.

- Indian airlines lack 20–25% spare crew buffers seen globally.

Way Forward

- Structural reforms needed beyond crisis management.

- Strengthen workforce, regulation, infrastructure, and fuel policy support.

- Essential as demand may reach 715 million passengers by 2030.