Introduction

- India’s healthcare system is at a defining juncture. With a population of 1.4 billion, the challenge is not just to provide access but to ensure affordability, equity, and quality.

- Rising non-communicable diseases (NCDs), environmental health burdens, urban-rural divides, and increasing costs make this sector both a developmental imperative and a governance challenge.

- India needs a holistic approach: strengthening insurance, embedding prevention in primary care, scaling efficiencies, accelerating digital adoption, ensuring regulatory trust, and mobilising sustainable investments.

Insurance as the Foundation of Affordability

- Risk pooling is the most effective mechanism to protect households from catastrophic expenses.

- Even modest premiums (₹5,000–20,000 individual; ₹10,000–50,000 family) can provide coverage worth several lakhs.

- Yet, penetration remains low:

- Only 15–18% of Indians insured.

- Premium-to-GDP ratio: 3.7% vs global average of 7%.

- Market growth potential: gross written premiums already at $15 billion (2024), expected to grow at 20% CAGR till 2030.

- Challenge: Insurance often acts as a crisis shield, not an everyday health-security tool.

- Way forward: Broaden insurance to cover OPD, diagnostics, and preventive services; integrate private and public players into a unified health-risk ecosystem.

Leveraging India’s Scale and Efficiency

- India has mastered delivering quality care at extraordinary volumes:

- Example: an MRI machine in India handles multiple times the daily scans compared to Western nations.

- Achieved through doctor–patient ratio optimisation, workflow design, and resource efficiency.

- Urban–rural divide: Tier-2 and Tier-3 cities remain underserved.

- Future strategy: Replicate urban efficiency models in smaller cities, supported by mobile health units, telemedicine, and PPP investments.

- If successful, India can set a global benchmark for combining scale, inclusion, and affordability.

Role of Government Schemes

Ayushman Bharat – PM Jan Arogya Yojana (PM-JAY):

- Coverage: ~500 million beneficiaries.

- Benefits: ₹5 lakh per family annually for hospitalisation.

- Impact: Enabled millions of cashless treatments; 90% rise in timely cancer care for beneficiaries.

- Health and Wellness Centres (AB-HWCs): bringing primary care and prevention closer to communities.

- Challenge: Limited private sector participation due to viability issues and delayed reimbursements.

- Way forward: Fair reimbursement models, transparent processes, and incentivising private hospitals to expand participation.

Prevention as the Most Powerful Cost-Saver

- NCDs (diabetes, hypertension, cardiovascular diseases) account for over 60% of deaths in India.

- A Punjab study showed insured families still faced catastrophic expenses for NCD outpatient care.

- Solutions:

- Redesign insurance to include OPD & diagnostics.

- Nationwide preventive push: lifestyle changes, nutrition awareness, school-based health programmes, employer-driven wellness schemes.

- Evidence: Every rupee invested in preventive care saves multiples in future treatment costs.

Digital Health and Technology Adoption

- Telemedicine: Enables specialists in metros to treat patients in villages remotely.

- Artificial Intelligence applications:

- Early detection of sepsis.

- Automated triaging of radiology reports.

- AI-enabled diagnostic decision support.

- Ayushman Bharat Digital Mission: Aims at universal health IDs, electronic health records, and continuity of care.

- Impact: Bridges rural-urban gaps, optimises doctor time, and reduces transaction costs.

Regulation, Trust and Governance

- Rising external pressures: insurers considering 10–15% premium hikes due to pollution-driven respiratory illnesses.

- Trust deficit: Low confidence in claims settlement and grievance redress deters households from buying insurance.

Need:

- Strengthened role of IRDAI in pricing oversight, claims transparency, and grievance handling.

- Regulations balancing viability for providers and affordability for patients.

- Learning: Just as SEBI built trust in India’s capital markets, IRDAI must build trust in India’s health-insurance markets.

Investment and Financing Challenges

- In 2023, India’s health sector attracted $5.5 billion in private equity and venture capital.

- But capital remains metro-centric, skewed toward large hospitals and pharmacy chains.

Gaps:

- Lack of financing for Tier-2/Tier-3 facilities.

- Weak rural infrastructure.

- Shortage of trained specialists.

- Way forward: Direct capital toward primary healthcare networks, rural hospitals, and training institutions. PPP models and viability-gap funding can channel investments into underserved regions.

Challenges in Building a Universal Model

1. Low public health expenditure: ~1.9% of GDP (well below global average of 6%).

2. High out-of-pocket expenditure: ~48% of total health spending (one of the highest globally).

3. Human resources gap: Shortage of doctors, nurses, and paramedics in rural India.

4. Urban bias: Over-concentration of hospitals and investments in metros.

5. NCD epidemic: Rapidly increasing burden of lifestyle diseases.

6. Fragmented insurance: Public schemes vs private insurers not well integrated.

Way Forward

1. Expand Insurance Coverage

- Make insurance universal, covering OPD, diagnostics, and preventive services.

- Link with Ayushman Bharat Digital Mission for portability and interoperability.

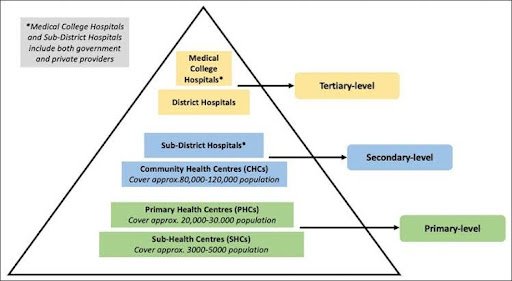

2. Strengthen Primary Care

- Scale up Health and Wellness Centres.

- Integrate preventive and promotive healthcare into primary systems.

3. Mobilise Private Sector

- Incentivise hospitals and startups to expand into Tier-2/3 cities.

- Ensure viability through fair reimbursements and PPP models.

4. Digital Transformation

- Universal adoption of health IDs, telemedicine, and AI tools.

- Promote interoperability of health records across states and hospitals.

5. Preventive Health Push

- National campaigns on nutrition, exercise, tobacco/alcohol control.

- Workplace-based wellness schemes.

- School curriculum integration for lifestyle awareness.

6. Regulation and Trust Building

- Strengthen IRDAI’s oversight on premiums and claims.

- Transparent grievance redress mechanisms to build confidence.

7. Sustained Investment

- Increase public health expenditure to at least 3% of GDP by 2030.

- Redirect private capital into rural health networks.

- Develop blended finance mechanisms (public + private).

UPSC Relevance

GS Paper II (Governance, Social Justice)

- Issues relating to development and management of health services.

- Welfare schemes for vulnerable sections (Ayushman Bharat, PM-JAY, AB-HWCs).

Mains Practice Questions

Q1. India’s health-care system has mastered the art of delivering quality care at scale, but affordability and rural access remain persistent challenges. Discuss how insurance, technology, and preventive health can be integrated to achieve universal health coverage.