Nagaland became the first Indian state to adopt the Disaster Risk Transfer Parametric Insurance Solution (DRTPS) after signing a MoU with SBI General Insurance.

About Parametric Insurance

- It is a type of insurance that covers probability/likelihood of a loss-causing event happening (E.g. earthquake) instead of compensating for actual loss incurred from event.

- It is an agreement that offers a pre-specified payment upon occurrence of a covered event meeting or exceeding a pre-defined intensity threshold, as measured by an objective value/parameter (hence name ‘parametric insurance’).

- Covered events: Could be earthquakes, tropical cyclones, or floods where parameter or index is magnitude, wind speed or water depth respectively.

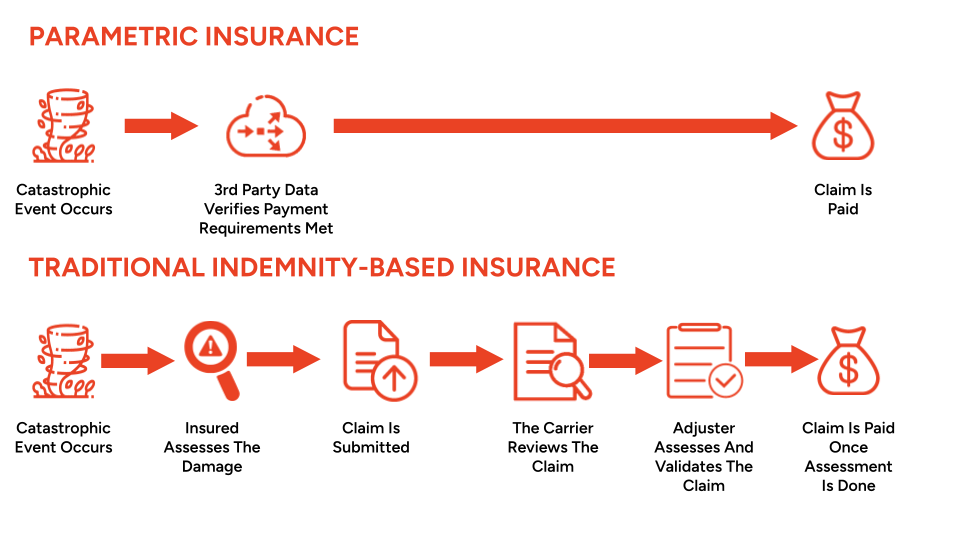

Difference between Traditional insurance and Parametric insurance

- Traditional insurance: It is best used to protect owned physical property.

- After an event, payments are based on actual loss sustained, subject to terms and conditions of policy.

- Parametric insurance: Payment is tied to loss-causing event occurring, and not the actual loss sustained, resulting in scope of coverage much broader.

- It can be used to increase the amount of coverage available to certain natural perils (i.e., named windstorm) that are of primary concern to the insured.

Advantages of parametric Insurance

- Speed of payout: Speedy payouts prevent policyholders from having to tap savings or credit to pay their losses

- Sense of certainty: The customer knows the precise amount to be received.

- Transparency: When trigger data is equally available to both the insurer and the policyholder, it reduces the perception of unfairness.