Context and Fiscal Background

- After the Union Budget, policy focus shifts toward the fiscal health of States.States play a crucial role in sustaining India’s overall growth momentum.

- During April–January FY2025, States’ revenue receipts increased by 18%.

- Actual revenues exceeded budget estimates, reflecting stronger fiscal performance.

- However, fiscal performance varied significantly across individual States.

Revenue Trends and Structural Drivers

- GST collections grew by 23%, surpassing the budgeted 22% growth.

- Improved compliance and expanding economic activity strengthened GST buoyancy.

- Lower GST rates and income tax rationalisation reduced potential revenue mobilisation.

- Strong revenue mobilisation offset lower devolution of excess Integrated GST funds.

- Stamp duty and registration revenues grew modestly at 11–13% annually.

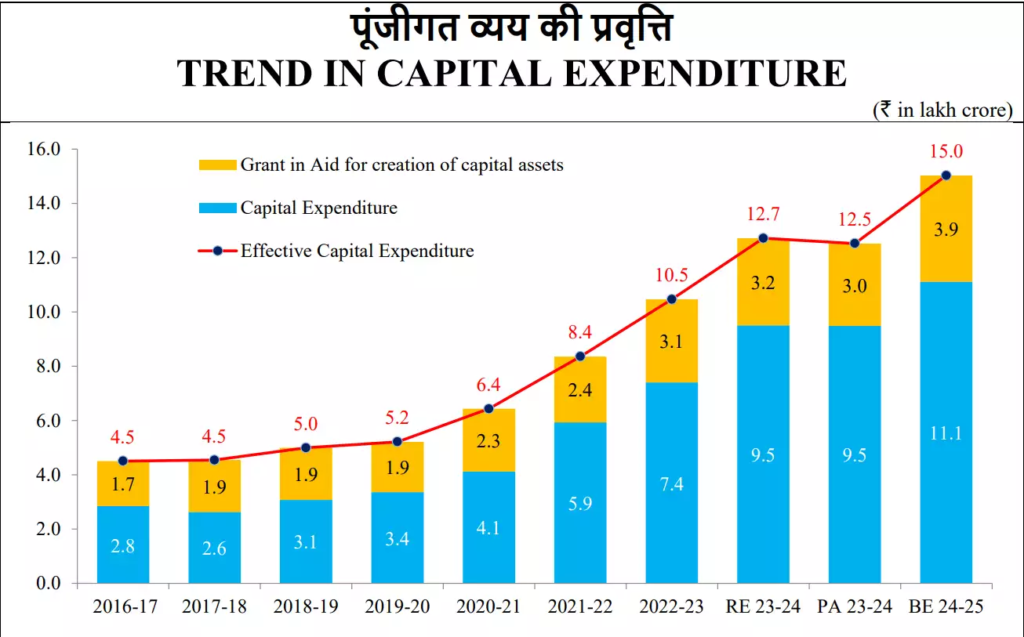

Capital Expenditure Performance

- States’ capital expenditure increased by 7.7% during April–January FY2025. This growth remains significantly below the budgeted 22% expansion target.

- However, capital spending surged by 25.7% in the third quarter. Thus the moderating revenue growth nudged States to slow revenue expenditure expansion.

- Sustained public capital investment remains essential for long-term economic growth.

Centre–State Fiscal Transfers

- Central grants to States were budgeted at ₹13.9 trillion this fiscal year. This amount was lower than previous actual transfers of ₹14.2 trillion.

- During April–November, Central grants declined by 18% year-on-year. States projected nearly 60% grant growth in the remaining months.

- Fiscal transfers significantly influence States’ developmental and infrastructure spending capacity.

Outlook and Growth Implications

- Moderating revenue growth may encourage States to restrain overall expenditure.

- However, sustained capital expenditure can crowd-in private investment effectively.

- The Centre’s 50-year interest-free capex loans support infrastructure development.

- Of the ₹1.5 trillion allocation, ₹1 trillion was disbursed by January 2025.

- Continued capital expenditure expansion can strengthen India’s macroeconomic stability.

About Capital Expenditure

- Meaning and Concept

- Capital Expenditure (CapEx) refers to spending on long-term productive assets. These assets provide economic benefits over several financial years.

- Such assets are not meant for sale but enhance productive capacity.

- Capital expenditure supports long-term development and increases earning potential.

- It is recorded as an asset and reduced gradually through depreciation.

- Key Features and Examples

- Capital expenditure creates assets that are not consumed within one year.

- It generally increases the capacity, efficiency, or life of assets.

- Examples include constructing buildings, highways, and public infrastructure.

- Purchasing machinery, land, vehicles, or upgrading technology are common instances.

- Such spending strengthens institutional and economic growth foundations.

- Significance of Capital Expenditure

- Capital expenditure promotes long-term economic growth and development.

- It enhances productivity by improving infrastructure and technological capability.

- Infrastructure investment generates employment and stimulates private investment.

- Improved public services enhance citizens’ overall quality of life.

- Higher public CapEx can create a positive multiplier effect in the economy.