Prelims

Retail Inflation – July 2025(India)

Why in News: Retail inflation in India fell to 1.55% in July 2025, its lowest in 8 years, driven by food price deflation, signaling easing price pressures below the RBI’s comfort band.

Retail Inflation

- Lowest in 8 years – 1.55% in July 2025 (lowest since June 2017).

- Below RBI’s comfort band – RBI target: 2%–6%.

- Continuous fall – Inflation eased for 9 consecutive months (CPI data – MoSPI).

Key Drivers:

A)Food & Beverages inflation:

- –0.8% in July 2025

- vs. –0.2% in June 2025

- vs. 5.1% in July 2024

B)Deflation in major food items:

- Vegetables: –21%

- Pulses: –14%

- Also declines in spices & meat.

Reasons for Food Deflation:

- High base effect.

- Falling prices of key food items.

- Good monsoon, adequate reservoir levels.

- Strong kharif sowing → higher agricultural output.

Core Inflation

- 4.1% in July 2025 (ex‑food & fuel).

- Down from 4.4% in June 2025.

- Near RBI’s medium‑term target of 4%.

Outlook

- Statistical high base to keep inflation low Sept–Dec 2025.

- Healthy agriculture & favourable base likely to contain food inflation further.

- Other CPI categories largely unchanged from previous month.

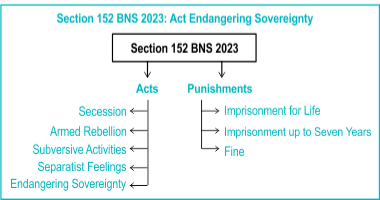

Section 152 of Bharatiya Nyaya Sanhita (BNS)

Why in News: Supreme Court questioned the potential misuse of Section 152 of BNS (punishing acts endangering India’s sovereignty) in the case of Siddharth Varadarajan and protected him and Foundation members from coercive police action.

Section 152 BNS (2023):

- Penalizes acts “endangering sovereignty, unity, and integrity of India.”

- Replaces the colonial sedition law (IPC Section 124A) but is seen as a “repackaged sedition law.”

- Criminalizes speech, writing, electronic, symbolic, financial acts that “excite or attempt to excite” secession, rebellion, or subversive activities.

- Punishable by life imprisonment or up to seven years and fine.

- Vaguely worded with broad, ambiguous terms like “subversive,” raising concerns of misuse against dissent and free speech.

Court Observations:

- Reference to Kedar Nath Singh case: Sedition applies only when speech incites violence or clear threat to sovereignty and unity. Mere political dissent cannot be sedition or offence under Section 152.

- Acts endangering sovereignty must be considered case by case, no general list can be fixed.

- Custodial interrogation not necessary in cases involving journalists.

Concerns Raised:

- Section 152’s vague and elastic terms could be misused to suppress legitimate dissent, minority voices, journalists, and civil society.

- The inclusion of financial acts increases risk of prosecutorial overreach.

- The provision might fail constitutional tests of clarity, proportionality, and necessity.

Drone-Based Artificial Rain Trial

Why in News: Rajasthan conducts India’s first drone-based artificial rain trial at Ramgarh Dam.

Technology: Uses 60 drones for cloud seeding, replacing traditional aeroplane-assisted methods.

Objective: Enhance rainfall through advanced cloud seeding techniques.

Partners: Rajasthan Agriculture Dept + GenX AI (US & Bengaluru).

Approvals: DGCA, India Meteorological Department (IMD), district authorities, agriculture department.

Launch: Public viewing

Cloud Seeding:

- Sprays silver iodide particles into clouds.

- Encourages precipitation (rain or snow).

- Used globally but results variable (5–20% increase in precipitation possible).

Drone Advantage:

- Greater precision and flexibility than airplanes.

- Potentially lower cost and higher efficiency.

- Effectiveness: Dependent on cloud presence and favourable weather.

- Environmental & Regulatory:

- DGCA ensures safe high-altitude operations.

- IMD coordinates meteorological conditions.

- Environmental impacts monitored.

Key Takeaway: First use of drones for artificial rain in India; a technological shift in weather modification.

Special Vostro Rupee Accounts (SVRA)

Why in News: RBI has simplified the process for opening Special Vostro Rupee Accounts (SVRA) by removing prior approval requirements for banks, aiming to speed up rupee-based trade settlements and promote international use of the Indian Rupee.

What: RBI removes prior approval requirement for banks to open SVRAs.

Purpose: Speeds up rupee-based trade settlements & promotes internationalization of INR.

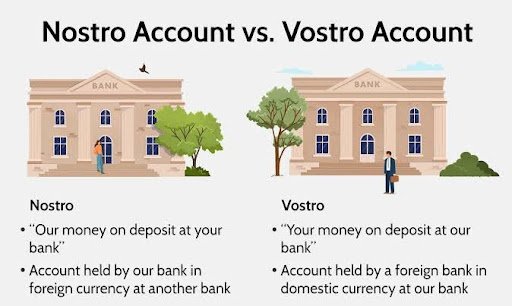

Key Terms:

- Vostro Account: Foreign bank’s account in an Indian bank in INR. Example: Citibank (USA) holds INR account in SBI → SBI’s Vostro Account.

- Nostro Account: Indian bank’s account in a foreign bank in foreign currency.

Internationalization of Currency (INR):

- Using a country’s currency beyond borders for trade, finance, reserves.

Benefits of Internationalization:

1. Reduces Forex Reserve Requirement: Less dependency on foreign currency reserves.

2. Enhanced Financial Market Development: More instruments & deeper domestic markets.

3. Economic Autonomy: Finance deficits via domestic currency debt instead of foreign debt.

4. Reduced Exchange Rate Risk: Exporters/importers transact in INR → lower currency fluctuation risk.

Other Steps by India:

- UPI internationalization for cross-border payments.

- Rupee-denominated bonds: Masala Bonds.

- MoUs with foreign central banks: UAE, Indonesia, Maldives → encourage local currency trade.

- Bilateral Currency Swap Agreements with select countries.